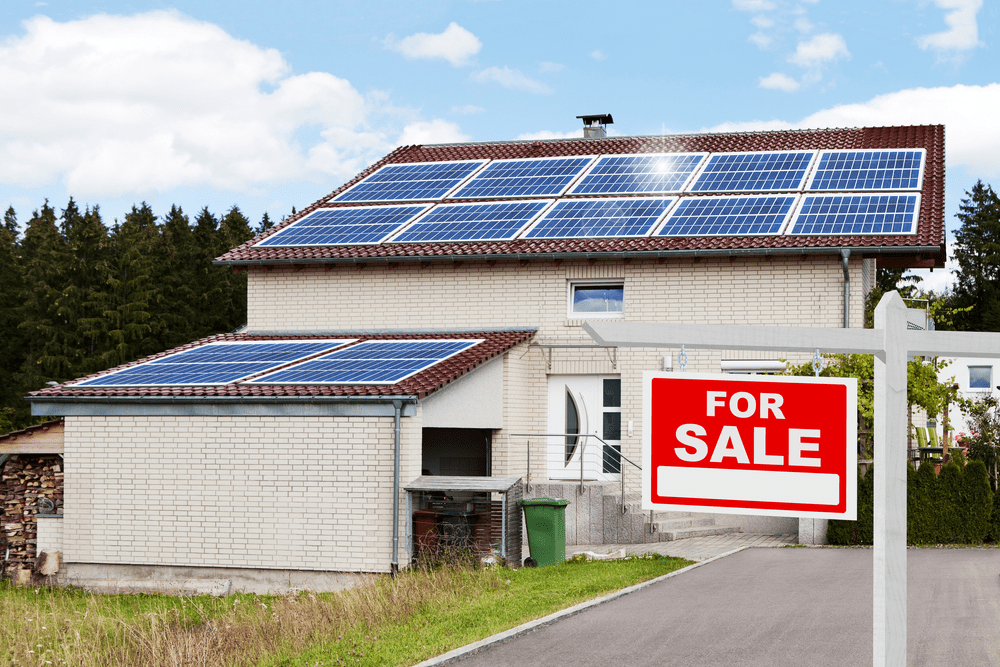

Selling Your House with Solar Panels: A Comprehensive Guide

When it comes to selling your house with solar panels, there are several key considerations that can significantly impact the selling process and the value of your property. Selling your New York home with solar panels requires a tailored approach that speaks directly to the preferences and concerns of local buyers. In this comprehensive guide, we’ll delve into the specifics of selling solar-equipped homes in the Empire State and provide expert insights to help you achieve a successful sale. 1. Showcasing New York-Specific Benefits of Solar Panels In the vibrant state of New York, solar panels offer a range of benefits that resonate deeply with potential homebuyers. These benefits include: Lower Energy Costs in a High-Energy Cost State: New York consistently ranks among the states with higher energy costs. Emphasize how solar panels can significantly reduce these costs, making your property an attractive choice for buyers looking to cut down on their utility bills. Supporting New York’s Green Initiatives: Highlight how choosing solar energy aligns with New York’s commitment to environmental sustainability. Emphasize the state’s efforts to transition to renewable energy sources and how your solar-equipped home plays a role in this transformation. Navigating Incentives and Tax Breaks: Mention the available incentives and tax breaks specific to New York that can make solar panel installation even more appealing for potential buyers. 2. Localized Solar Panel Performance Data Local buyers are likely to be interested in the performance of solar panels within New York’s climate. Provide detailed information on: Seasonal Energy Generation: Create a mermaid syntax diagram to illustrate the seasonal energy generation of your solar panels in the New York climate. This visual representation can help buyers understand how your solar panels perform throughout the year. 3. Navigating New York’s Solar Programs Educate potential buyers on the specific solar programs and regulations in New York: Net Metering Policies: Explain New York’s net metering policies that allow homeowners to receive credit for excess energy generated by their solar panels. Community Solar Options: Highlight the availability of community solar programs in New York, showcasing how these options can benefit buyers who want to support renewable energy without installing panels on their property. 4. Addressing Urban Aesthetics and Rooftop Solar New York’s diverse landscape presents unique considerations for solar panel integration: Urban Aesthetics: Explain how solar panels can seamlessly integrate into urban environments, enhancing the aesthetics of rooftops and contributing to the modern look of the city. Shared Rooftop Solar: For properties with shared rooftops, discuss the feasibility of shared solar installations and the advantages they offer in densely populated areas. 5. Collaborating with Local Real Estate Professionals Work with experienced real estate agents who are familiar with New York’s real estate market and sustainability trends: Leveraging Local Expertise: Utilize your real estate agent’s knowledge of New York neighborhoods and market preferences to position your solar-equipped home strategically. Promoting New York’s Green Lifestyle: Empower your agent to communicate the value of a solar-equipped home within the context of New York’s environmentally conscious culture. 6. Highlighting New York’s Solar-Ready Future Emphasize the role your solar-equipped home plays in New York’s clean energy future: Supporting State Goals: Showcase how your solar-equipped home contributes to New York’s ambitious clean energy targets and how it aligns with the state’s vision. Conclusion Selling your New York home with solar panels requires a nuanced approach that speaks to the state’s unique characteristics and the preferences of local buyers. By showcasing New York-specific benefits, providing localized performance data, navigating state programs, addressing urban considerations, collaborating with local professionals, and highlighting the role in New York’s clean energy future, you can position your solar-equipped property as a compelling option for buyers who are passionate about sustainability. Reach out to Cash Buyers NY today to learn more about our expert services tailored for selling solar-equipped homes in New York.

Selling Your House with Solar Panels: A Comprehensive Guide Read More »